The Reserve Bank of India (RBI) plays a pivotal role in the regulation and supervision of the financial sector in India, particularly concerning Non-Banking Financial Companies (NBFCs). The RBI Approved NBFC List is a crucial resource for consumers and businesses seeking financial services outside traditional banking institutions. This list not only provides transparency but also ensures that the entities listed adhere to the regulatory framework established by the RBI, thereby safeguarding the interests of borrowers.

With the growing demand for alternative financing options, understanding the significance of this list becomes essential for anyone looking to engage with NBFCs. The RBI Approved NBFC List serves as a benchmark for quality and reliability in the financial services sector. It includes various types of NBFCs, such as those involved in asset financing, loan provision, and investment activities.

By consulting this list, potential borrowers can identify legitimate and compliant financial institutions, reducing the risk of fraud or exploitation. As digital transformation continues to reshape the financial landscape, many of these NBFCs have developed innovative loan applications that streamline the borrowing process, making it more accessible and user-friendly.

Key Takeaways

- The RBI approved NBFC list includes non-banking financial companies that have been authorized by the Reserve Bank of India to provide financial services.

- Non-Banking Financial Companies (NBFCs) are financial institutions that offer banking services like loans, credit facilities, and investment options, but do not hold a banking license.

- The RBI has specific criteria for approving NBFCs, including minimum net owned funds, track record of profitability, and compliance with regulatory guidelines.

- The best loan apps from the RBI approved NBFC list offer features such as quick approval, competitive interest rates, flexible repayment options, and transparent terms and conditions.

- Loan apps from RBI approved NBFCs provide benefits such as easy access to funds, minimal documentation, online application process, and personalized customer support.

Understanding Non-Banking Financial Companies (NBFCs)

Non-Banking Financial Companies (NBFCs) are financial institutions that provide a range of banking services without holding a banking license. They play a crucial role in the Indian economy by offering loans, credit facilities, and investment products to individuals and businesses. Unlike traditional banks, NBFCs do not accept demand deposits, which means they cannot offer savings accounts or current accounts.

However, they are authorized to provide various financial services, including personal loans, vehicle loans, home loans, and business loans. The operational framework of NBFCs is governed by the RBI under the Reserve Bank of India Act, 1934. This regulatory oversight ensures that NBFCs maintain certain capital adequacy ratios and adhere to prudential norms.

The diversity within the NBFC sector is noteworthy; it encompasses a wide range of entities such as asset finance companies, investment companies, and microfinance institutions. Each type of NBFC caters to different segments of the market, thereby enhancing financial inclusion and providing credit to underserved populations.

Criteria for Approval by RBI

To be included in the RBI Approved NBFC List, companies must meet specific criteria set forth by the Reserve Bank of India. These criteria are designed to ensure that only financially sound and compliant entities operate within the sector. One of the primary requirements is that an NBFC must have a minimum net owned fund (NOF) of ₹2 crore.

This capital requirement serves as a buffer against potential losses and ensures that the company has sufficient resources to conduct its operations effectively. In addition to capital requirements, NBFCs must also demonstrate sound governance practices and risk management frameworks. The RBI evaluates the management quality, operational efficiency, and financial health of these companies before granting approval.

Regular audits and compliance checks are conducted to ensure ongoing adherence to regulatory standards. Furthermore, NBFCs are required to maintain a certain level of liquidity and follow guidelines related to asset classification and provisioning for bad debts. This rigorous approval process helps maintain stability in the financial system while protecting consumers from unscrupulous practices.

Best Loan Apps from RBI Approved NBFC List

| Loan App Name | Interest Rate | Tenure | Maximum Loan Amount |

|---|---|---|---|

| App 1 | 8% | 1-5 years | ₹50,000 |

| App 2 | 9% | 1-7 years | ₹1,00,000 |

| App 3 | 7.5% | 1-10 years | ₹2,00,000 |

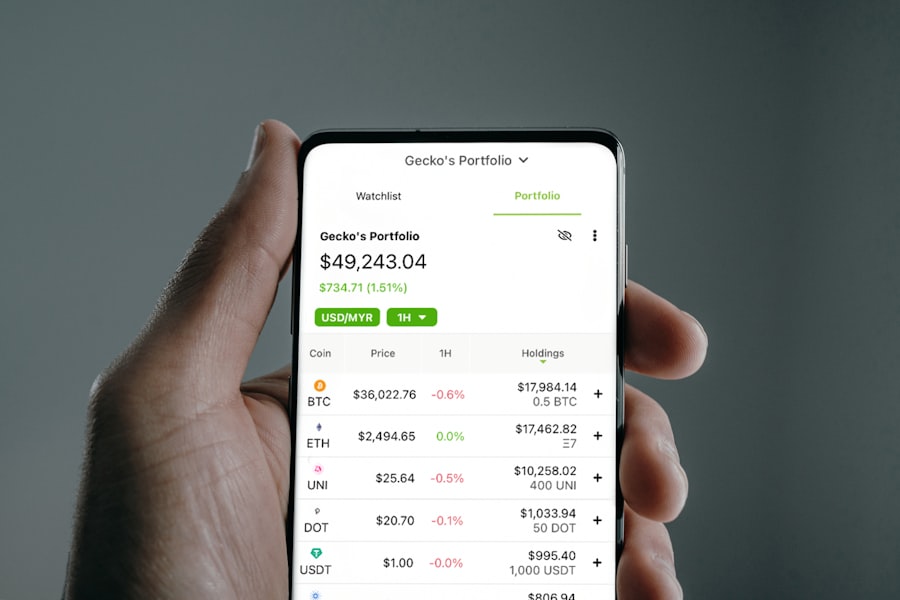

With the proliferation of technology in finance, many RBI-approved NBFCs have developed mobile applications that facilitate easy access to loans. These loan apps have transformed how individuals and businesses approach borrowing by providing a seamless digital experience. Among the top contenders in this space are companies like Bajaj Finserv, Lendingkart, and PaySense.

Each of these platforms offers unique features tailored to meet diverse borrowing needs. Bajaj Finserv’s app stands out for its user-friendly interface and extensive range of loan products, including personal loans, home loans, and business loans. The application process is straightforward; users can apply for loans directly through their smartphones with minimal documentation.

Lendingkart focuses on small businesses, providing quick access to working capital loans with flexible repayment options. Their app utilizes advanced algorithms to assess creditworthiness swiftly, enabling faster disbursal of funds. PaySense caters primarily to individual borrowers looking for personal loans with competitive interest rates and flexible repayment terms.

Features and Benefits of Loan Apps

Loan apps from RBI-approved NBFCs come equipped with various features designed to enhance user experience and streamline the borrowing process. One significant advantage is the speed at which loans can be processed. Traditional banks often require extensive documentation and lengthy approval times; however, loan apps can facilitate instant approvals in many cases.

This rapid turnaround is particularly beneficial for individuals or businesses facing urgent financial needs. Another notable feature is the transparency offered by these apps regarding interest rates and fees. Borrowers can easily compare different loan products within the app itself, allowing them to make informed decisions based on their financial circumstances.

Additionally, many loan apps provide personalized loan offers based on users’ credit profiles, ensuring that borrowers receive terms that suit their needs. The convenience of applying for loans from anywhere at any time further enhances accessibility, making it easier for individuals who may not have easy access to physical bank branches.

How to Apply for Loans through NBFCs

Applying for loans through RBI-approved NBFCs has become increasingly straightforward due to advancements in technology. The first step typically involves downloading the loan app from a reputable NBFC’s website or app store. Once installed, users need to create an account by providing basic personal information such as name, contact details, and income information.

This initial registration process is usually quick and user-friendly. After setting up an account, borrowers can explore various loan products available on the platform. Each product will have detailed information regarding eligibility criteria, interest rates, repayment terms, and required documentation.

Users can select a loan that best fits their needs and proceed with the application process by submitting necessary documents such as identity proof, income proof, and bank statements through the app itself. Many apps utilize digital verification methods to expedite this process further. Once submitted, applications are reviewed promptly, often resulting in quick approvals and disbursal of funds directly into the borrower’s bank account.

Comparing Loan Apps from Different NBFCs

When considering a loan app from an RBI-approved NBFC, it is essential to compare various options to find the best fit for individual needs. Factors such as interest rates, processing fees, repayment terms, and customer service should be evaluated carefully. For instance, while one app may offer lower interest rates, it might come with higher processing fees that could negate any savings on interest payments.

Additionally, borrowers should consider the flexibility of repayment options offered by different NBFCs. Some apps may provide features like prepayment options without penalties or extended repayment periods that can ease financial pressure during challenging times. Customer reviews and ratings can also provide valuable insights into user experiences with different loan apps.

By conducting thorough research and comparisons across multiple platforms, borrowers can make informed decisions that align with their financial goals.

Tips for Choosing the Right Loan App

Selecting the right loan app from an RBI-approved NBFC requires careful consideration of several factors to ensure a positive borrowing experience. First and foremost, borrowers should verify that the NBFC is indeed listed on the RBI Approved NBFC List to ensure compliance with regulatory standards. This step is crucial in avoiding potential scams or unregulated lenders that could lead to unfavorable terms or hidden fees.

Another important tip is to assess one’s own financial situation before applying for a loan. Understanding personal credit scores can significantly impact loan eligibility and interest rates offered by different apps. Borrowers should also evaluate their repayment capacity realistically; choosing a loan amount that aligns with their income will help avoid future financial strain.

Lastly, it is advisable to read through all terms and conditions associated with a loan product before signing any agreements. This diligence will help borrowers avoid surprises down the line and ensure they fully understand their obligations under the loan agreement. In conclusion, navigating the world of loans through RBI-approved NBFCs can be simplified by leveraging technology and understanding key factors involved in the borrowing process.

By utilizing reputable loan apps and adhering to best practices when selecting a lender, borrowers can access much-needed funds while ensuring their financial well-being remains intact.

FAQs

What is an RBI approved NBFC?

An RBI approved NBFC is a non-banking financial company that has been granted approval by the Reserve Bank of India to carry out financial activities such as lending, investment, and asset financing.

What is the significance of being on the RBI approved NBFC list?

Being on the RBI approved NBFC list signifies that the company has met the regulatory requirements set by the Reserve Bank of India and is authorized to operate as a financial institution in India.

What types of financial services can an RBI approved NBFC provide?

An RBI approved NBFC can provide a range of financial services including loans, advances, investments in stocks and bonds, hire purchase, and other credit services.

How can I verify if a loan app is from an RBI approved NBFC?

You can verify if a loan app is from an RBI approved NBFC by checking the company’s registration and authorization details on the Reserve Bank of India’s official website or by contacting the RBI directly.

Are loans from RBI approved NBFCs safe?

Loans from RBI approved NBFCs are generally considered safe as these companies are regulated by the Reserve Bank of India and are required to adhere to certain financial and operational guidelines to ensure the safety of customer funds.